Expert SPV Services

Creating the Best Digital Solutions for Your Business

We empower you to launch the business of your dreams. Our experts offer personalised support for registering a company, navigating regulations and achieving your goals.

Google Reviews

5.0

Excellent based on 4 reviews

Trustindex Reviews

5.0

Excellent based on 2 reviews

Trusted by Property Investors, Business Owners, Overseas Investors and many more.

Built for Your Success

Why Choose Us ?

Unlock a world of tax efficiency and investment benefits by setting up your own Special Purpose Vehicle.

Worldwide Support

Experience expert assistance through email and phone, no matter where you are in the world.

Dedicated Support

Our expert team is available to assist with any queries, guiding you through the incorporation process

Professional Business Identity

Every package includes a web domain service, giving your business a professional online presence

Seamless Bank Account Setup

Get assistance with setting up a business bank account, making financial transactions smoother

Corporate Governance

Receive documents like the first board meeting minutes to establish a solid governance framework

Scalability & Flexibility

Whether you’re starting small or planning for growth, our packages offer adaptable solutions

Expert Business Assistance

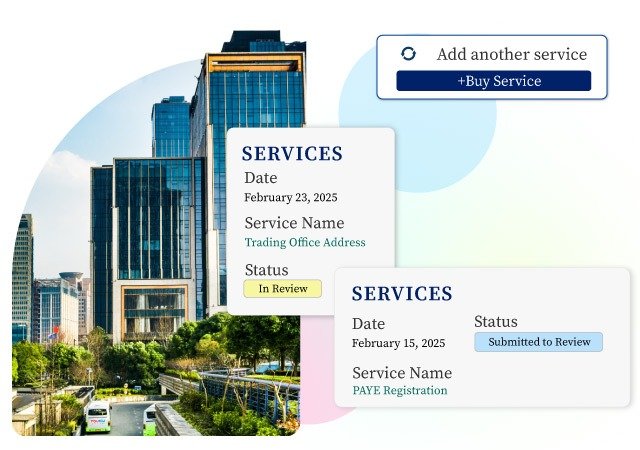

Company Services

Discover a range of additional services designed to simplify your property investment process and support your SPV needs every step of the way.

Confirmation Statement

File your annual CS01 to keep company details updated with Companies House.

Company Dissolution & Strike-off

Legally close your company, ensuring debts and filings are settled.

Company Address Change

Update your registered or trading address for official communications.

Officers Appointment & Termination

Appoint or remove directors and secretaries, keeping records compliant.

Change in PSC & RLE

Update Persons with Significant Control (PSC) or Legal Entities (RLEs).

Registration & Removal of charges

Register or remove loans and securities on company assets.

Full Company Secretary Service

Ensure compliance, filings, and governance with a company secretary.

Multiple Class of Shares

Create different share classes for flexibility and investor rights.

Customised Article of Association

Tailor your company rules, governance, and shareholding structure.

Dormant Company Accounts Filing

If your property limited company is inactive and not trading, you are still required to file Dormant Company Accounts annually with Companies House.

Change in Shareholding Structure

Whether you’re bringing in new investors or transferring ownership, a change in your company’s shareholding structure must be managed properly.

Business Address Simplified

Address Services

Discover a range of additional services designed to simplify your property investment process and support your SPV needs every step of the way.

Registered Office Address Service

Use a prestigious UK address for your company’s official registration, ensuring compliance with Companies House and HMRC.

Trading Office Address Service

Establish a professional business presence with a dedicated trading address to receive client correspondence and enhance credibility.

SPV Steps

How We Work?

Getting started with property investment has never been easier. In just a few easy steps, you can set up your Property Limited Company.

Buy Now

Fill Business Details

Make Your Payment

FAQs

General Questions Answered

Get quick answers to common questions about SPV formation services. Our FAQs cover everything you need to know for your property investment journey.

Hear From Our Valued Customers

Patrice Kiiru

Trustpilot Reviews

5.0

Excellent based on 4 reviews

Google Reviews

5.0

Excellent based on 4 reviews

An SPV is a separate legal entity created specifically to purchase and manage property investments, isolating financial risk from the parent company.

Benefits include potential tax advantages, liability protection, and simplified management of property assets.

Yes, but this process may involve costs such as Stamp Duty Land Tax, legal fees, and potential Capital Gains Tax liabilities.

Yes, many lenders offer mortgage products tailored for SPVs, often with terms differing from individual buy-to-let mortgages.

Ready to Step in?

Let Property SPV Guide You

Let Property SPV provide the guidance and solutions you need. Contact us today or book a free 15-minute discovery call.